When venturing into the commercial real estate market, understanding the various property types is crucial. Commercial properties can include office spaces, retail locations, industrial warehouses, multifamily complexes, and undeveloped land. Each category serves a specific sector of the economy and comes with its set of investment considerations, such as expected yields, tenant types, lease structures, and market demand dynamics.

Warehouse for Sale

Warehouses have become particularly attractive as logistical and e-commerce demands surge. An investment in a warehouse can offer substantial rewards, especially when located in logistic hotspots with access to major transportation routes. When considering a warehouse for sale, potential investors should evaluate the building’s specifications, such as ceiling height, loading docks, and floor strength, as well as its ability to adapt to technological advancements in logistics.

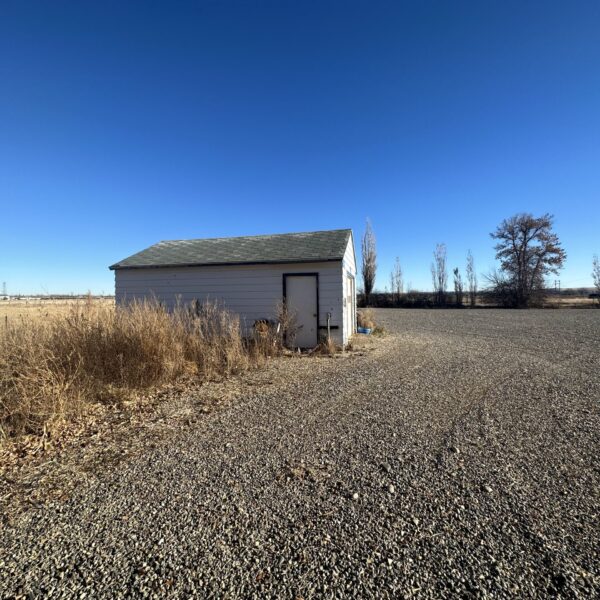

Land for Sale

Investing in land presents opportunities for substantial appreciation, especially when it’s located on the path of future development. Land can be a versatile investment, with potential uses ranging from commercial development to agricultural or residential projects. Key factors to consider when looking at land for sale include location, topography, access to utilities, zoning regulations, and long-term area planning. Land investments typically require a longer-term perspective and a readiness to navigate the intricacies of development from the ground up.

Crafting Your Commercial Real Estate Portfolio: Insights on Property Types and Market Dynamics

In building a diversified commercial real estate portfolio, investors should weigh the unique characteristics and market demands of different property types. Offices cater to professional services and corporate tenants, retail spaces hinge on consumer foot traffic and spending patterns, while industrial properties like warehouses serve the burgeoning logistics sector. Multifamily assets often offer lower risk through diversified tenant bases, and specialty properties like medical offices or self-storage facilities can provide niche market opportunities. Recognizing the cyclical nature and regional variances of these markets is key to informed investment strategies.

Navigating the Warehouse Market: A Buyer’s Roadmap to Industrial Investments

The rise of e-commerce and just-in-time delivery models has bolstered the warehouse sector, making it a focal point for commercial investors. An effective approach to entering the warehouse market involves understanding the nuances of industrial demand, including the impact of last-mile delivery efficiencies, the role of automation in storage and retrieval, and the geographic importance of trade hubs. Evaluating the potential for a warehouse property entails analyzing existing tenant agreements, building specs conducive to modern logistics, and scalability options for future expansions or renovations.

Land Acquisition Strategies: Unearthing Potential in Untapped Parcels

Land acquisition is often the first step in a visionary development project. Prospective buyers should approach land for sale with a strategic lens, considering not only the current value but the future potential. This involves thorough due diligence on land entitlements, environmental assessments, and alignment with municipal growth plans. Seasoned land investors often capitalize on value-added opportunities, such as securing permits, improving accessibility, or repurposing the land to higher and better uses in anticipation of evolving market trends.

Investing in Commercial Real Estate: A Long-Term Commitment with High-Yield Potential

Commercial real estate investments require a long-term commitment and proper due diligence to reap the rewards fully. However, for investors seeking stable cash flow and potential appreciation, commercial properties like warehouses and land can offer excellent opportunities. By understanding the unique demands of various property types and conducting thorough market research, investors can build a diversified and resilient commercial real estate portfolio. So, whether you’re a seasoned investor or just starting in the world of commercial real estate, consider the benefits of investing in warehouses and land for a promising future in the industry.

The Strategic Investor’s Path to Commercial Real Estate Success

Investing in commercial real estate demands a blend of market insight, foresight, and strategic acumen. Whether one’s interest lies in the resilient warehouse sector, the foundational asset class of office buildings, or the boundless potential of raw land, each investment avenue offers unique challenges and opportunities. A carefully crafted commercial real estate investment portfolio, informed by deep market understanding and a clear sense of one’s investment goals, can yield impressive dividends and contribute to a robust financial future.