The realm of commercial real estate is vast and diverse, encompassing various types of properties that cater to different business needs. Among these, warehouses and land hold significant importance for investors, businesses, and developers alike. This article delves into the nuances of these two commercial real estate segments, highlighting their unique characteristics, market demands, and considerations for potential buyers.

Warehouses: A Pillar of Commerce and Industry

Warehouses play a critical role in the logistics and distribution chain, serving as storage centers for goods before they are distributed to retailers or directly to consumers. The surge in e-commerce has notably increased the demand for warehouse spaces, making them a hot commodity in the commercial real estate market. When considering the purchase of a warehouse, potential buyers should evaluate several key factors:

- Location: Proximity to transportation hubs, such as highways, ports, and railroads, is crucial for efficient logistics and distribution.

- Size and Layout: The size of the warehouse and its layout should align with the operational needs, including storage requirements, inventory management, and shipping/receiving areas.

- Technology and Infrastructure: Modern warehouses often incorporate technology for inventory management and security. Assessing the infrastructure’s capability to support these technologies is vital.

- Market Trends: Understanding local and national market trends can help investors gauge the warehouse segment’s growth potential and profitability.

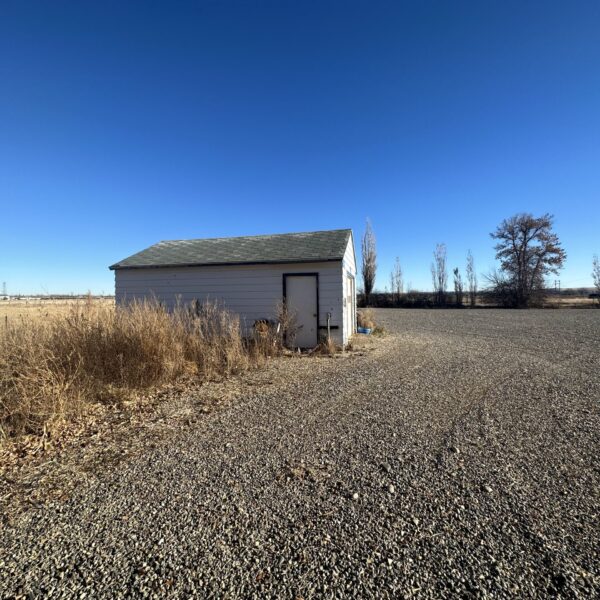

Land: The Foundation of Development

Land sales in commercial real estate represent opportunities for development and investment. Whether for constructing a new facility, developing a residential complex, or holding it as an investment for future appreciation, buying land offers a canvas for realizing a vision. Before embarking on a land purchase, consider the following:

- Zoning and Use Restrictions: Confirm the land is zoned for the intended use, whether commercial, industrial, or mixed-use, and understand any restrictions that may apply.

- Location and Accessibility: The value of land is heavily influenced by its location and ease of access. Consider factors such as visibility, proximity to major roads, and surrounding development.

- Utilities and Infrastructure: Assess the availability of essential utilities and infrastructure, including water, electricity, gas, and sewage. The cost of bringing these services to an undeveloped parcel can significantly impact the overall investment.

- Environmental Assessments: Conducting environmental assessments can uncover potential issues, such as contamination or protected habitats, which could affect development plans or costs.

Navigating the Market

The commercial real estate market for warehouses and land is competitive and dynamic. Potential buyers should conduct thorough market research, engage with knowledgeable real estate professionals, and consider future trends that may impact the value and utility of the property. Whether for investment or operational purposes, warehouses and land offer substantial opportunities for growth and development in the commercial real estate landscape.

In conclusion, understanding the specific characteristics and market demands of warehouses and land is crucial for anyone looking to invest in commercial real estate. With careful planning, due diligence, and strategic decision-making, these properties can offer significant returns and serve as the foundation for successful business ventures.

Keys to Successful Investment in Commercial Real Estate

Investing in commercial real estate, particularly in warehouses and land, requires a strategic approach and an understanding of the market dynamics. Successful investors often emphasize the importance of due diligence, including comprehensive market research, financial analysis, and understanding the legal aspects of real estate transactions. Identifying properties with potential for appreciation, or those that meet a specific demand in the market, can significantly enhance the investment’s profitability. Additionally, building relationships with industry experts and engaging with a knowledgeable commercial real estate agent can provide valuable insights and opportunities, making the process smoother and more efficient.

Strategies for Financing Commercial Real Estate Investments

Financing plays a pivotal role in the acquisition of commercial real estate, with various options available to investors depending on their needs, the property type, and the investment strategy. Traditional bank loans remain a common choice, offering relatively low-interest rates for those who meet the stringent credit requirements. Real estate investment trusts (REITs) and private lenders provide alternative financing sources, often with more flexible terms but potentially higher costs. Investors should also consider the benefits of leveraging Small Business Administration (SBA) loans for certain types of commercial properties, which can offer favorable terms and lower down payments. Analyzing the terms, rates, and requirements of different financing options is crucial in making an informed decision that aligns with the investor’s financial goals and capabilities.