In the dynamic world of real estate, commercial properties stand out as powerful investments that can yield substantial returns. These assets encompass various types, each with unique characteristics and investment potential. Among them, warehouses have emerged as lucrative ventures due to the e-commerce boom, while land sales continue to attract investors with their promise of long-term appreciation. This document delves into the complex ecosystem of commercial real estate, decoding the nuances of different property types and examining the strategic considerations behind warehouses and land transactions.

Commercial real estate is an expansive field offering various types of properties to suit diverse business and investment needs. From functional warehouses to vacant land ripe for development, understanding these different categories is crucial for making informed decisions. Let’s explore the primary types of commercial real estate below.

Office Spaces

Offices are perhaps the most recognizable form of commercial real estate, encompassing properties used for administrative or professional purposes. These spaces feature individual offices, conference rooms, and common areas that facilitate work and meetings. Office buildings can vary in size from small standalone structures to sprawling corporate complexes. They are typically located in central business districts or commercial hubs, making them easily accessible to employees and clients.

Office spaces are attractive investments that can generate high rental income due to their high demand. However, they also require significant capital investment and maintenance costs. Furthermore, the success of office properties is closely tied to economic conditions and job market trends.

Types of Commercial Real Estate

Commercial properties vary significantly, each serving unique purposes:

- Office Buildings: These are spaces where businesses operate. They range from small individual offices to large skyscrapers and are commonly found in both urban and suburban areas.

- Retail Spaces: This category includes shopping malls, strip centers, and individual stores. Retail properties are designed to accommodate consumer-facing businesses.

- Industrial Properties: These are essential for companies needing space for manufacturing, storage, or distribution. This category includes warehouses, factories, and distribution centers, usually located outside densely populated urban areas for ease of transportation and expansion.

- Multifamily Properties: This type refers to residential buildings like apartments and condominiums, which are often part of commercial real estate when used for rental income and investment purposes.

- Special-Purpose Properties: These are buildings designed for specific uses, like hotels, hospitals, schools, or even parking lots, catering to particular business needs.

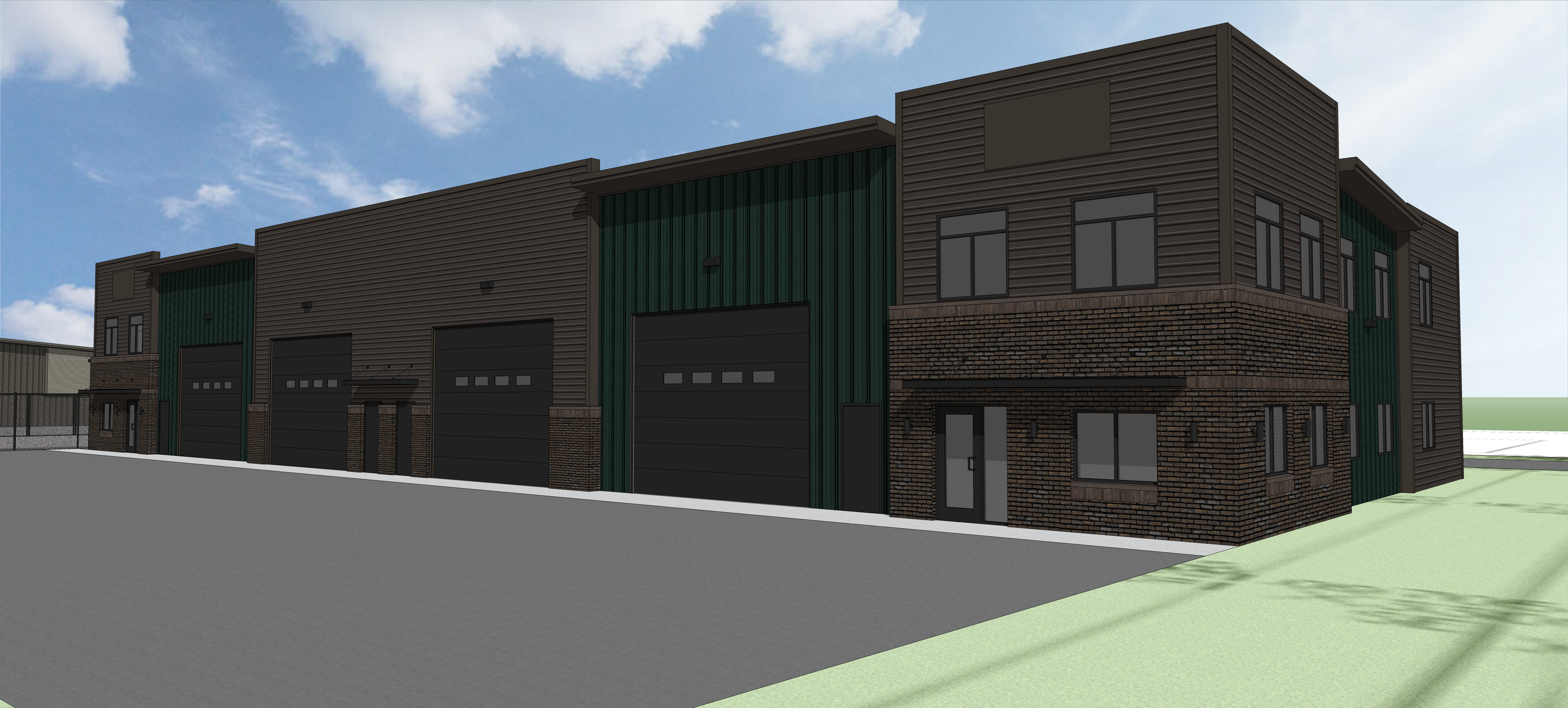

Warehouses: A Vital Part of Commercial Real Estate

Warehouses play a critical role in the storage and distribution sector, particularly with the rise of e-commerce. When considering a warehouse for sale, important factors include its location relative to major transport routes, size, storage capacity, and specific features like docking facilities and ceiling height.

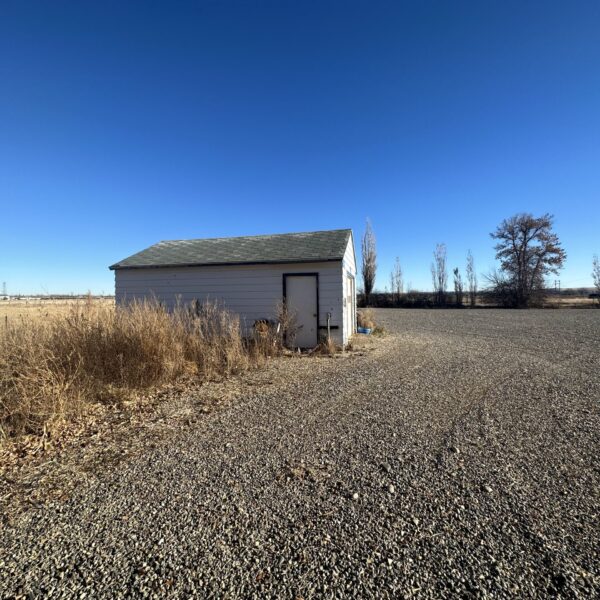

Land Sales in Commercial Real Estate

Investing in land offers a unique opportunity. Unlike developed properties, land provides a blank canvas to create a property that perfectly fits specific requirements. When looking at land for sale, important considerations include the location, zoning regulations, potential for appreciation, and development costs. Land investment can range from purchasing undeveloped parcels in rural areas to acquiring strategically located plots in urban centers.

Making Informed Decisions in Commercial Real Estate

Investing in commercial real estate, be it a warehouse or a plot of land, requires understanding local market trends, zoning laws, and long-term regional development plans. Each type of commercial property offers different risks and rewards, and the choice depends on the investor’s business strategy and goals. Additionally, financing plays a significant role in these transactions. Investors must carefully assess their financial capabilities and seek expert advice to make sound decisions.

As the world continues to evolve, commercial real estate remains a dynamic field offering attractive investment opportunities. Understanding the different types of properties available and the strategic considerations behind each transaction is key to making informed decisions and maximizing returns in this lucrative sector.

For those interested in commercial real estate, whether it’s acquiring a warehouse for logistical needs or purchasing land for development, it’s essential to conduct thorough research and seek expert advice. Real estate professionals can provide valuable insights and guidance tailored to your specific investment objectives. With the right knowledge and strategy, commercial real estate can be a profitable and rewarding venture. So explore the possibilities, assess your options, and take calculated risks to unlock the full potential of this exciting investment avenue.