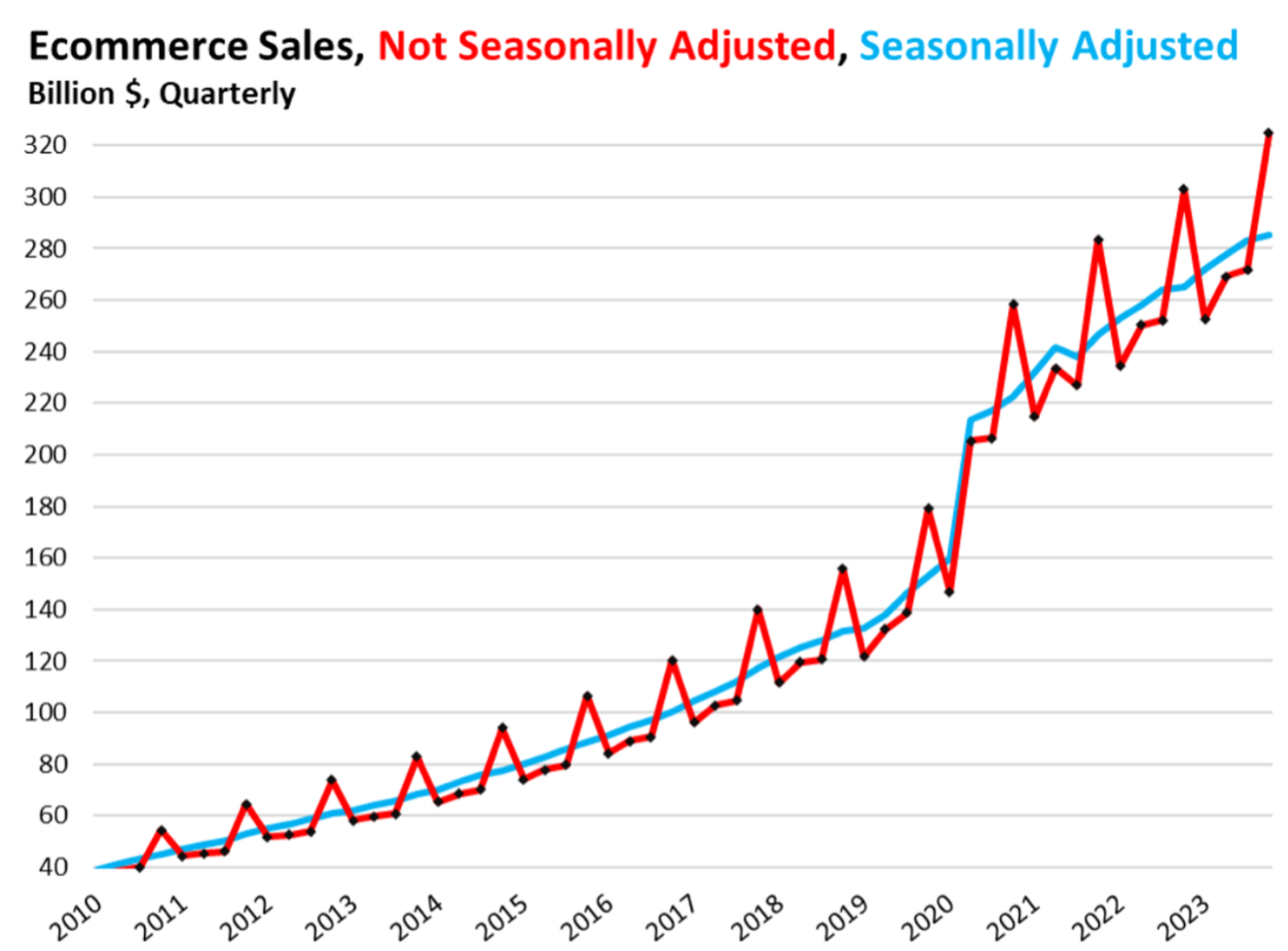

The Census Bureau recently reported that total ecommerce sales in the US soared by 7.2% year-over-year in Q4 2023, reaching an all-time high of $325 billion. The explosion in ecommerce sales began in 2020 amidst widespread lockdowns and retail closures, driven by consumers’ reluctance to venture out amid pandemic risks and the injection of stimulus funds into households. According to insights from Wolf Street, from Q4 2019 to Q4 2020, ecommerce sales surged by a staggering 44%, leaping from $179 billion to $258 billion. This growth trend persisted, with sales continuing to skyrocket each year, culminating in Q4 2023’s milestone of $325 billion—an astounding 82% increase from Q4 2019.

Last month’s earnings report from Walmart highlights the impact of ecommerce on retail sales. Despite being the second largest ecommerce retailer in the US, Walmart still trails far behind Amazon. In Q4, Walmart US experienced a significant surge of 17% in ecommerce sales year-over-year, while overall Walmart US sales, encompassing ecommerce, saw a more modest increase of 3.4%. Comparable sales (excluding fuel), which incorporate ecommerce transactions, witnessed a 4.0% growth compared to the previous year. Within this 4% growth, ecommerce accounted for 2.4 percentage points, while all other sales, including grocery sales, contributed 1.4 percentage points.

Walmart revealed its position as the largest grocery seller in the US, boasting “mid single-digit” growth in grocery sales, particularly in the realm of fresh food. The company noted an increase in market share within the broader US grocery market, as reported by Nielsen. While its ecommerce segment experienced a robust 17% growth, and its substantial grocery sales saw mid-single-digit expansion, the performance of its remaining merchandise at brick-and-mortar stores—excluding ecommerce and grocery—appeared lackluster, as acknowledged in its presentation citing “softness in general merchandise.”

According to the latest data from the Census Bureau, US retail trade sales, excluding ecommerce, edged up by only 1.5% year-over-year in Q4, reaching $1.58 trillion. The report underscores several notable trends:

– In Q2 2020, sales stagnated at levels similar to Q1 2020, failing to rebound from the typical Q1 decline.

– In Q2 2021, sales surged as stores reopened and another round of stimulus checks stimulated spending.

– In Q2 2022, sales spiked once more, partly driven by inflationary pressures, as CPI inflation surged to 9%, causing double-digit price increases across many product categories.

– Since Q2 2022, growth in retail sales, excluding ecommerce, has been sluggish, with ecommerce largely propelling the overall expansion in retail trade sales.

These remarkable surges in ecommerce sales underscore a seismic shift in consumer behavior, with online shopping rapidly reshaping the retail landscape. For commercial real estate investors, understanding and anticipating these trends is crucial. As ecommerce continues to thrive, traditional brick-and-mortar retail spaces may face challenges, while demand for distribution centers and last-mile logistics facilities surges.