While the overall economy has proven to be resilient to interest rate increases, the gap between buyers and sellers on cap rates is still pretty significant, which has resulted in lower transaction volumes compared to the prior year. In conversations with Coldwell Banker Commercial professionals across the country, only a few markets are seeing sellers come down on pricing to meet buyers’ expectations and create deal terms that make sense in a higher interest rate environment. The majority of property owners prefer to hold on to their assets hoping for increased valuations over last year. Buyers are trying to put deals together but believe pricing should be 10-15% less than what sellers are asking for. Properties will move only if priced right, and even then, deals are slower to close (which is an improvement from the “no-decision” days of last year). While real estate is still a desired asset class, nervousness about timing is holding buyers back. A slowing domestic economy, rising interest rates with an uncertain end and the war in Ukraine has led many investors to park their money in risk-free bonds while they wait for values to come down. Cap rate spread over 10-year US treasury yields are below historic average spreads across all property types.

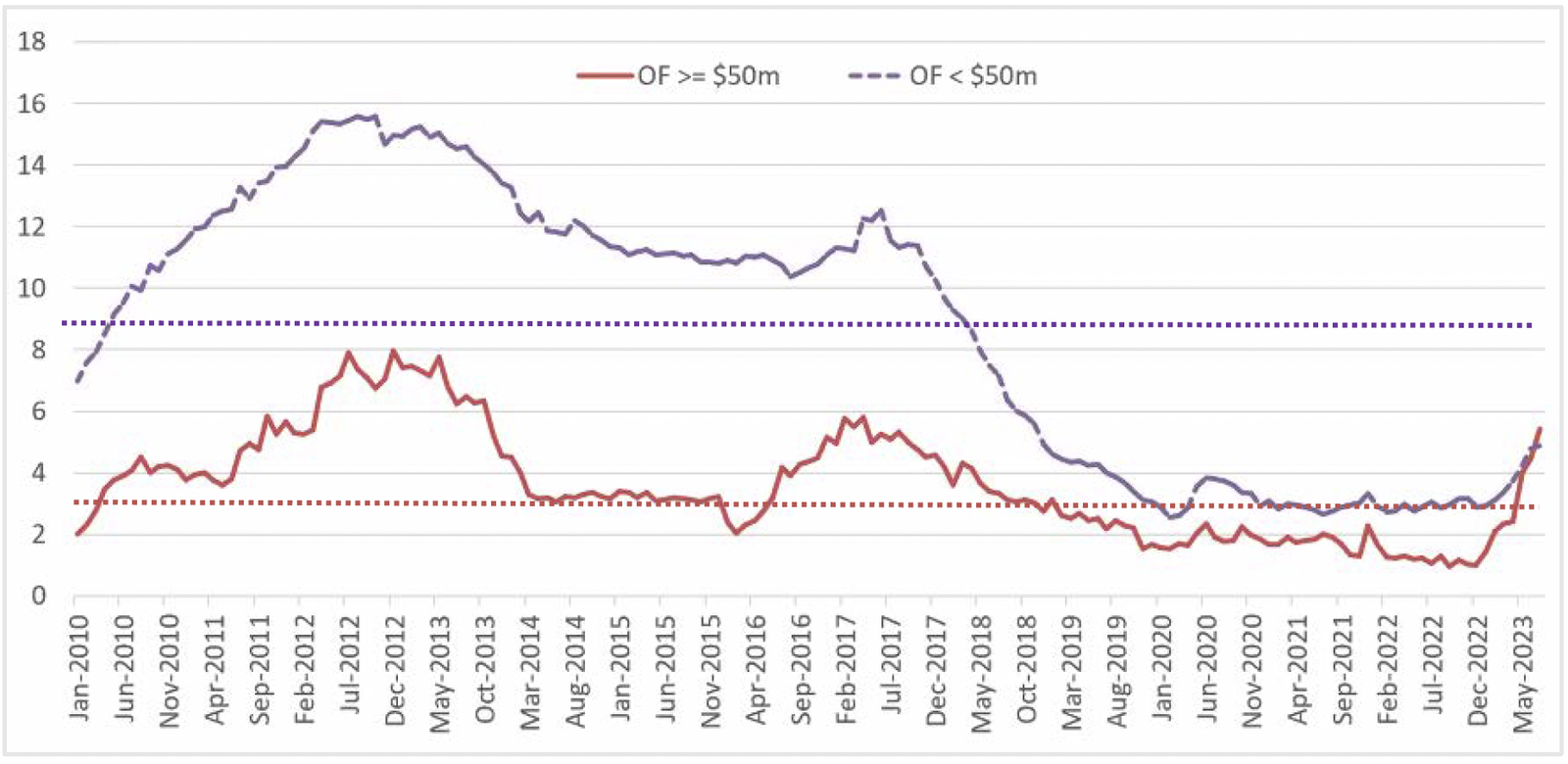

Exhibit 1: Cap Rate Yield Spread Over 10-Year US Treasuries

Source: CBC Research, U.S. Department of The Treasury, CoStar.

Bank lending is very tight; cash is king. Tighter lending standards (70% pre-lease rates vs. 30-50% pre-COVID; 25-50% down; 65% LTVs) have significantly reduced the flow of bank credit to developers, small businesses, and investors across the country. Property investment sales have slowed down considerably as bank financing has been very hard to get. Only the most seasoned equity groups and long-standing relationships are getting approval. As such, many commercial players have turned to seller financing and other blended solutions. Owner-users are driving most of the purchases in markets with all-cash offers. Deals are being struck out of necessity by businesses that desperately need space right now – for them, it’s not about cap rates, it’s their livelihood. With the exception of 1031 exchange and cash buyers, property investors are not budging when cap rates go from 5% to 6.5% because they would be borrowing money at 8% – doesn’t make financial sense.

Seller financing has become key to doing deals. To keep both parties at the deal table, our commercial professionals have primarily been suggesting seller financing – and it has proven to be a great vehicle. Sellers get their asking price over time while buyers typically get a better rate than they would from a bank and better terms from the property owner. It also takes the appraisal guesswork out (allowing deals to close more quickly) and removes the burden of having to find a 1031 or paying capital gains. This type of financing works well for retirees and anyone who doesn’t need a big influx of cash; it’s become a popular tool across all property types, with many sellers willing to undercut the bank rates.

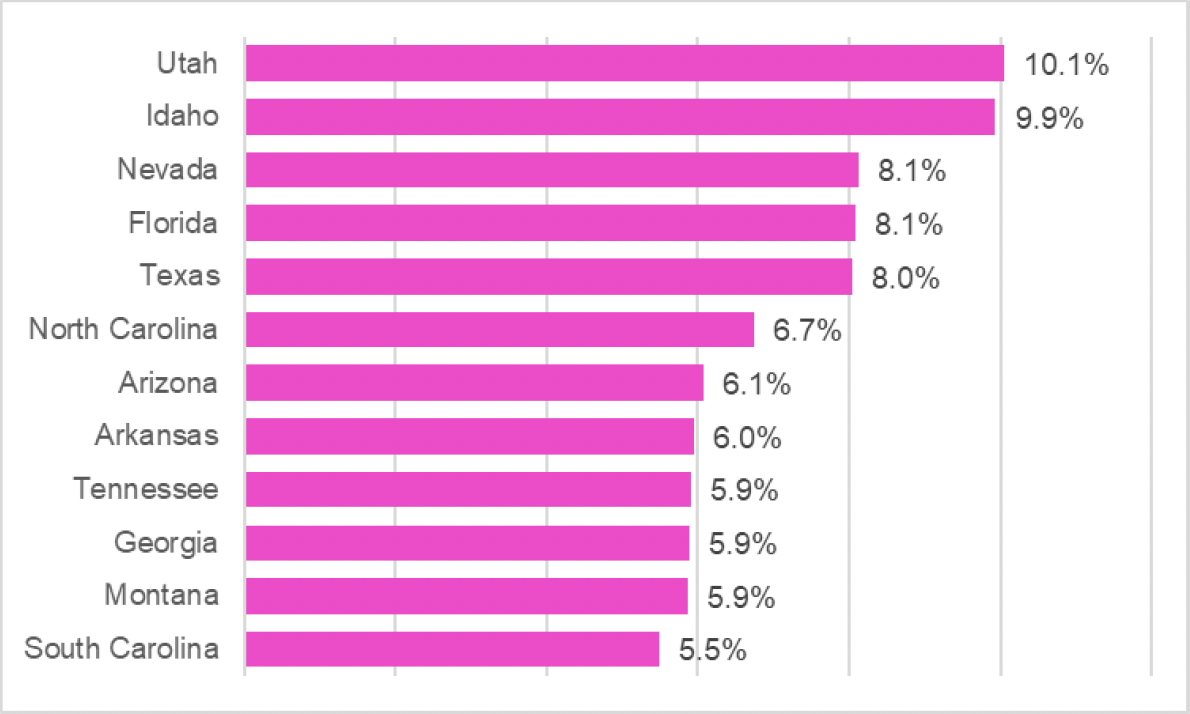

Leasing is where the market pulse is. With so many sellers holding onto their assets, buyers have been pivoting to lease space. With a steady flow of companies and employees relocating to secondary and tertiary markets (Exhibit 2), we are seeing robust leasing activity in nearly every sector: retail, industrial, flex warehouse and small office – resulting in some tenants having very few options (depending on product type). Despite rising lease rates during the past 12 months, tenants are not pushing back. Shortage of good real estate, high construction costs and growth of small businesses will likely keep driving people to lease rather than buy over the next 6-9 months, especially if it allows them to enter new markets.

Exhibit 2: Top States with Biggest Job Growth Since March 2020

Source: CBC Research, US Bureau of Labor Statistics data through June 2023.

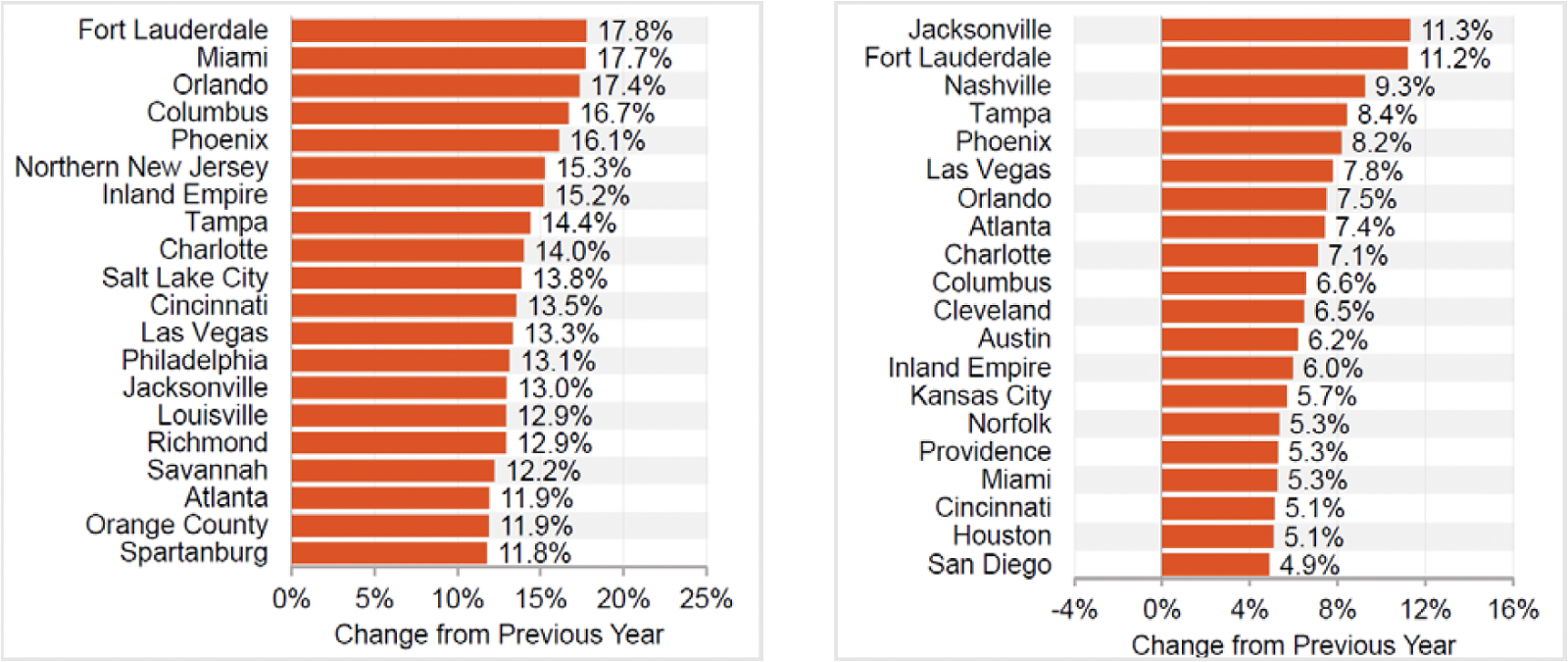

Exhibit 3: Industrial Rent Growth, Top Markets / Exhibit 4: Retail Rent Growth, Top Markets

Source: CoStar data through May 2023. Data includes markets with 100M+ Square Feet inventory.

Top tenants. Small neighborhood businesses are seeing significant growth across the country and have been driving most of the activity in our markets. The greatest demand for retail space comes from owner-users that provide a service: doctors; physical therapists; massage spas; pharmacies; pet groomers; credit unions; insurance companies; education centers; cycle bars; fast casual restaurants; coffee shops and ice cream parlors. Small to midsize flex warehouses are also in high demand as fulfillment companies, utilities contractors, sports equipment manufacturers, ghost kitchens and home décor companies all vie for the few spaces that are available in any given market. And while large office buildings continue to struggle, small offices are leasing very well – often generating offers over ask from family-run medical practices; accounting and engineering firms; lawyers; staffing companies; and even other retailers looking for less expensive space. Expect these types of businesses to be the biggest drivers over the next year.

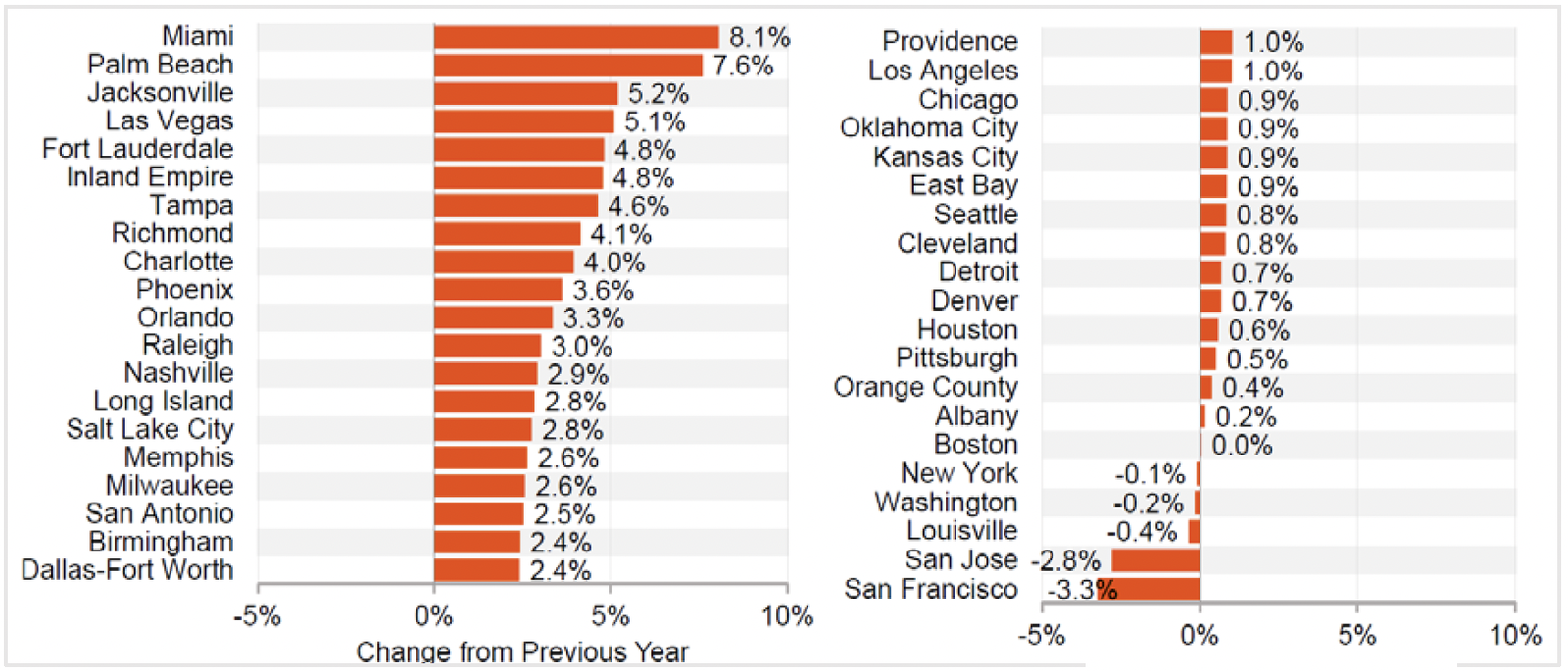

Exhibit 5: Office Rent Growth Markets

Source: CoStar data through May 2023. Data includes markets with 50M+ Square Feet inventory.

Small office demand up 2.5x over LY. With corporate employees now working from home, large office buildings are seeing record vacancies, particularly in central business districts. One option to create viable office demand is for landlords to make office space more amenable to smaller tenants (1000-5000 SF). Big companies that own or lease high-rise buildings are now reshuffling their needs and looking to rent out large portions of shadow space as they deal with 75% vacancy rates. White collar employees are resisting the return to downtown. Instead, they are staying in the suburbs and companies are swapping downtown office space for locations closer to employee homes – while still reducing overall demand. Over the long term, we expect office space utilization to continue to be below pre-pandemic levels for the foreseeable future. This will undoubtedly create problems for property owners and lenders (particularly for the larger buildings) as property loans mature (Exhibit 6). Office property conversion to multifamily has limited feasibility with issues related to natural light, zoning, plumbing and other structural issues not to mention financial sense.

Exhibit 6: Delinquency of Large vs. Small Office Loans

Source: Trepp, Inc.

Owner-users doing all the building; little spec product. Migration into lower-cost states never stopped post-pandemic. However, we have seen very little new construction come online to meet the demand of new residents. High construction and financing costs have slowed down new development in many markets. Meanwhile, developers with mega projects now have to use multiple lenders to complete their jobs (as individual banks are not willing to take on 100% of the risk anymore). Owner-users that want small spaces (under 50,000 sf) have been the only ones willing to pay such high prices to support their businesses. Landlords are comfortable collecting rent from fully occupied buildings and maintaining the status quo. As such, our professionals see little spec construction; the few that do come online get leased very fast.

Land in high demand. While vacant land continues to be highly sought after by owner-users and developers with national tenants, industrial land with utilities attached are in even greater demand as companies from the coasts keep relocating to business-friendly states like Idaho, Arizona, Texas and Florida. While land has been difficult to find, some of our markets have been seeing an uptick in available land parcels as the baby boomer population offloads their generational property because they are aging out of family businesses that none of their children want to takeover.

Conclusion. Despite concerns over the economy and differences in pricing expectations, CRE activity is still happening. While the uncertainty about the economy and interest rates means activity will be tepid through the remainder of the year, our Coldwell Banker Commercial professionals expect improvement next year assuming there is less uncertainty in the market and prices/cap rates become aligned with alternative investment returns. For now, we expect industrial, retail and small office to lead property demand. We believe multifamily development will also continue at a brisk pace but only in select markets. Our professionals expect investment property transaction volume to continue to be below 2022 levels and owner/user transactions will make up part of the slack.

Jane Thorn Leeson is a Research & Resources Analyst with Coldwell Banker Commercial.

Coldwell Banker Commercial®, provides commercial real estate solutions serving the needs of owners and occupiers in the leasing, acquisition and disposition of all property types. With a collaborative network of independently owned and operated affiliates, the Coldwell Banker Commercial organization comprises almost 200 companies and more than 3,000 professionals throughout the U.S. and internationally.